What is authentication?

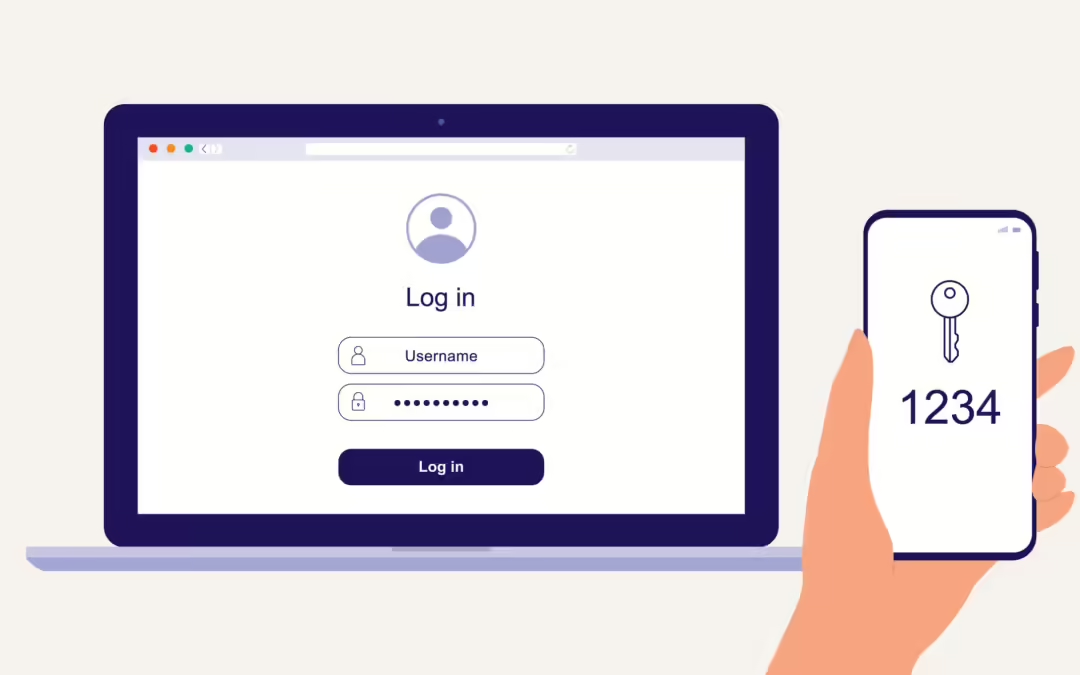

Authentication is the process or action of verifying the identity of a user or process.

5 Common Authentication Types

- Password-based authentication. Passwords are the most common methods of authentication

- Multi-factor authentication

- Certificate-based authentication

- Biometric authentication

- Token-based authentication

Why do banks authenticate customers?

- Authentication ensures that customers, their data and their assets are kept safe. It can help by creating a variety of hurdles before granting access to personal information or accounts.

- Authentication helps to build trust and reputation. It ensures that only authorized individuals or systems can access sensitive information and helps protect an organization’s reputation. Customers, partners, and other stakeholders are more likely to trust an organization that implements robust authentication methods.

- In 2023, the Federal Trade Commission (FTC) received over 1 million reports of identity theft through its IdentityTheft.gov website. This number is down from 1.107 million in 2022 and 1.434 million in 2021. The most common type of identity theft in 2023 was credit card fraud, with 426,000 reports, down from 448,000 in 2022. Government documents or benefits fraud also increased by 68% in 2023, after declining by 85% in 2022

- Experts believe that these cases occur so often that there is a new victim every 22 seconds. Most studies indicate that this ratio will increase in 2024, making it a bigger issue for Americans.

If you don’t have authentication factors established for your bank accounts and would like to get more information on how Arvest can help to protect your accounts and information from fraudsters give us a call at 866-952-9523 or visit your nearest Arvest bank for assistance.

Arvest bank associates are here to help assist you with protecting your assets from scams!

If you feel you have been a victim of fraud you can report suspicious activities to the Federal Trade Commission at ReportFraud.ftc.gov, as well as Arvest Bank. In addition, most social media platforms have ways to report user profiles that were either taken over or created with the malicious intent of scamming people.